The Full form of DCISU in banking and financial sector is Debit Card Issue Charge. Debit card issuance may incur transaction fees imposed by financial institutions. Credit unions and banks charge this fee to compensate for the administrative expenses they incur when issuing debit cards to account holders. Despite the convenience of debit cards, banks may cover debit card maintenance and servicing expenses through various fees assessed. In this post, we’ll examine the DCISU full form and grab extensive knowledge on the topics.

Debit cards enable the execution of monetary transactions within the digital economy. Credit card issuers, however, expend a great deal. The Debit Card Issue Charge (DCISU) covers administrative expenses for issuing debit cards. Comprehending the DCISU facilitates comprehension of the operational mechanisms of contemporary institutions.

Meaning of DCISU (Debit Card Issue Charge)

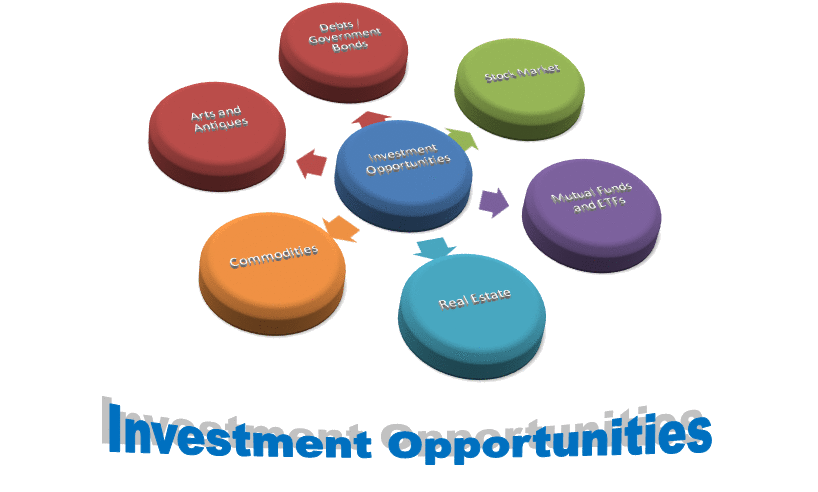

Financial institutions, including credit unions and banks, commonly assess a Debit Card Issue Charge (DCISU) on issuing institutions for debit cards. This charge encompasses administrative expenses such as production, personalization, and distribution of debit cards to account holders. It serves to mitigate the expenses associated with card issuance. The expenses consist of card creation, account information encryption, and secure transmission.

The Debit Card Issue Charge encompasses the expenses associated with card activation, account setup, and customer service provision. This fee enables financial institutions to recoup the operational expenses associated with their debit card services.

Examples of DCISU

The Debit Card Issue Charge (DCISU) emerged with the rise in popularity of debit cards as a substitute for currency transactions. In the second half of the twentieth century, as electronic payment methods acquired popularity, banks began providing debit cards to customers for easy access to funds. As a consequence of new technologies and security measures, debit card fees have increased.

In order to recover these expenses, financial institutions imposed debit card issuance fees on a routine basis. Legislative restrictions, market conditions, and technological advancements have all impacted the structure and amount of these fees. Despite efforts to ensure transparency and equity through oversight and regulation, debit card issuance fees continue to be a widespread aspect of contemporary banking services.

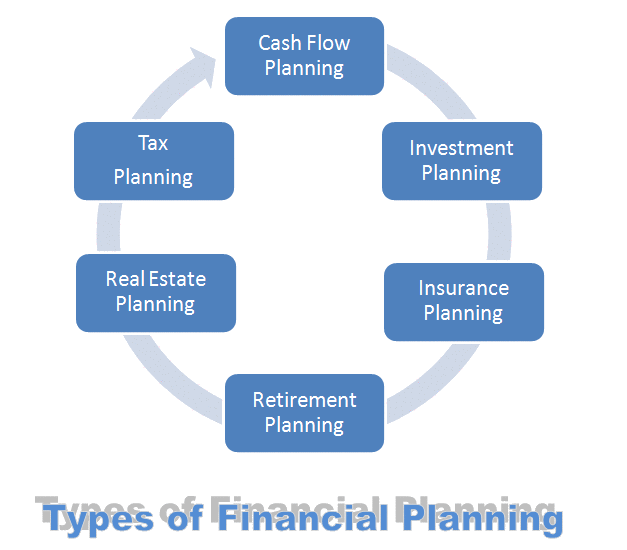

Functions of Debit Card Issue Charge

Debit card convenience has revolutionized the way individuals manage their funds in contemporary banking. Financial institutions steer customers through frictionless transactions, concealing a structure of fees and levies. Despite the convenience, customers often overlook the Debit Card Issue Charge when using banking services. Despite its seemingly insignificant nature, this fee compensates for a substantial proportion of the administrative expenses linked to the issuance of debit cards.

Covering Administrative Expenses

The DCISU primarily administers debit card expenses. Additionally, it oversees other financial transactions. These costs consist of the production, customization, and shipment of the cards.

Offsetting Operational Costs

The DCISU contributes to the expenses incurred by financial institutions for debit card activation, account creation, and customer service.

Supporting Technology Investments

DCISU may invest its funds in infrastructure and technological advancements aimed at enhancing the security and effectiveness of debit cards. Additionally, it can explore opportunities to bolster debit card security and efficiency through such investments.

Regulatory Compliance

Financial institutions may set aside a portion of DCISU revenues in order to comply with debit card and data security regulations. Moreover, they might allocate these funds to ensure adherence to regulatory requirements and safeguard sensitive information.

Revenue Generation

The DCISU facilitates the profitability and sustainability of financial institutions operating in a competitive market.

Features of Debit Card Issue Charge (DCISU)

Financial institutions impose the Debit Card Issue Charge to cover administration fees related to debit cards. This charge includes expenses for card design, personalization, and distribution.

Transparency

We must inform clients about the DCISU and any associated fees. This information is disclosed through regulatory disclosures, charge schedules, and customer accounts. Additionally, clients are notified of the DCISU and its associated fees through regulatory disclosures, charge schedules, and their customer accounts.

Consumer Rights

Clients can lodge formal complaints with regulatory bodies or seek legal recourse if they deem DCISU charges unlawful or excessive. Moreover, they have the option to address matters pertaining to financial institutions.

Variability

The amount is contingent upon the customer’s relationship with the financial institution (e.g., bank or credit union), the type of account, and the issuing institution.

Waivers and Discounts

Certain financial institutions offer DCISU waivers or discounts as promotional or loyalty initiatives. Included among these account holders are senior citizens, students, and devoted bank patrons.

Regulatory Oversight

By imposing restrictions on the DCISU, regulators can safeguard consumers and promote equity. Examples of potential regulations include fee limits, prohibitions on unfair or misleading conduct, and transparency standards.

FAQ

How Much is the Typical DCISU, and does it Vary between Banks?

The quantity of the DCISU may vary between banks. Potentially influencing the situation are the account type, issuing institution, and customer bank connection. Financial institutions typically include the DCISU amount in their fee schedules or account agreements.

Why do Banks Need to Charge a Fee for Issuing Debit Cards?

The issuance of debit cards incurs administrative and operational expenses for banks. Card creation, personalization, activation, and customer service are all included in these fees. By aiding banks in recouping these expenses, the DCISU ensures the profitability of debit cards.

Is the DCISU a One-time Charge, or will i Incur it Regularly?

Clients frequently incur a one-time DCISU when they initiate an account or request a debit card. Replacement or retention of the card may incur additional fees, contingent upon the policies of the financial institution. These fees may consist of annual or replacement card charges.

Final Words

Debit cards are currently an option provided by banks and credit unions. Financial services are consistently undergoing transformation due to technological advances. Using a debit card does not entail the elimination of the Debit Card Issue Charge. This expense encompasses the labor involved in designing, personalizing, and shipping debit cards to account holders. Additionally, it covers the costs associated with these processes. Gaining insight into the purpose and consequences of the DCISU facilitates comprehension of contemporary banking processes.