Three terms—trade, investing, and speculation—have different meanings yet often coexist in the vast field of finance. Even though these terms are commonly used synonymously in everyday conversation, they refer to different approaches and perspectives on the financial markets, each with its own set of advantages, disadvantages, and strategies. Let us understand what is the difference between trading, investment and speculation in this topic.

To properly manage cash and grasp financial market complexity, one must understand the differences between trading, investing, and speculation. In this analysis, we’ll explore the key distinctions between trade, investment, and speculation, revealing their unique characteristics, objectives, and implications in the financial industry.

Difference Between Trading, Investment and Speculation

We have spoken to numerous people involved in investment activities for some time. We realized that people didn’t understand the difference between Trading, Investment, and Speculation. So, we decided to add this article to our learning materials. Our goal is to clarify and improve readers’ knowledge when they are reading tutorials on the basic concepts of investment.

There are few terms which possess almost same meaning but in real terms there is a vast differences. Let us understand about difference between Trading, Investment and Speculation.

Trading

Trading is the regular buying and selling of financial instruments across brief time frames (minutes to days), including derivatives, equities, currencies, and commodities. Traders use strategies including technical analysis, chart patterns, and algorithmic trading in an attempt to profit from brief price fluctuations. Traders aim to capitalize on market fluctuations, unlike long-term investors, and employ strategies like leverage and derivatives to augment potential profits.

Mostly traders adopt ‘Buy and Sell’ strategy to make profit from short term investment. Activities performed while investing is termed as trading or trading activities. For example: trading activities involve buying stocks, selling properties, purchasing gold with the proceeds, and trading stocks. Traders focus on short-term price fluctuations to determine when to buy or sell assets. They analyze graphs, charts, and patterns of stocks or other assets to predict short-term price movements and make decisions accordingly.

Investment

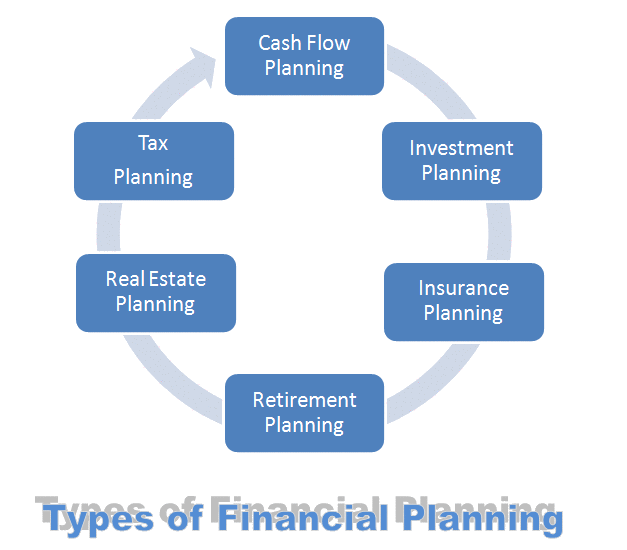

Investing involves acquiring assets with the intention of holding them for an extended period, often spanning years or even decades. Investors employ fundamental research to evaluate a company’s financial health, industry trends, and macroeconomic conditions, enabling them to make informed capital allocation decisions. Investors focus building long-term wealth through strategies including buy-and-hold, dollar-cost averaging, and portfolio diversification, as opposed to chasing quick profits. Their strategy aims to generate returns through dividends, interest, and capital appreciation. It is characterized by patience, discipline, and a long-term vision.

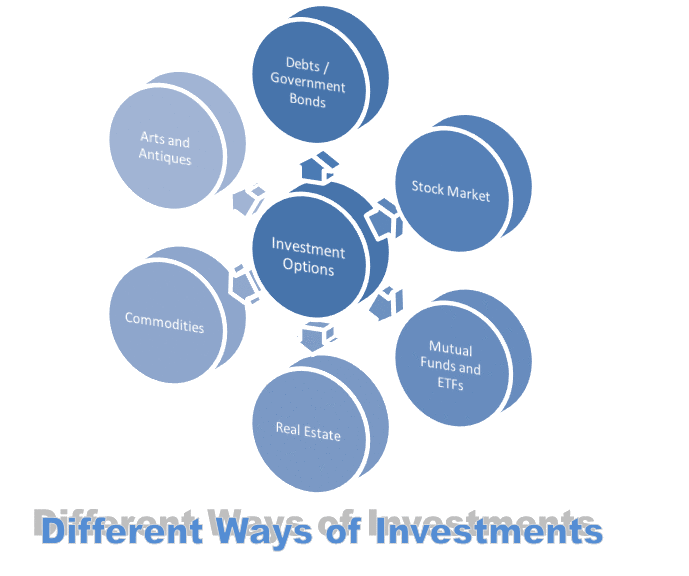

Mostly Investors adopt ‘Buy and Hold’ strategically to make handsome profit from long term investment. Investing means proactive use of cash to generate wealth. In other words rather you work for money let money works for you thru the means of investing. For example: buying assets like stocks, precious metals, properties, bonds, etc with the intension to sell on the future date with capital appreciation returns.

Assets encompass a wide range of items, such as fine arts, rare coins, mutual funds, bonds, properties, stocks, antiques, copyright materials, trademarks, patents, or any other intellectual properties. The capital appreciation, expected returns, potential profit, or potential risk associated with each asset class varies.

Speculation

Speculation, unlike investing, involves accepting greater risks for potentially higher returns. Speculators invest in financial assets based on their predictions of future price movements. They typically rely on rumors, news, and current market conditions to make decisions. Speculators are mainly motivated by the anticipation of short-to-medium-term price fluctuations. This differs from traders who focus on short-term changes and investors who prioritize long-term growth. While speculative investing can lead to significant profits, it also comes with a high level of risk. This is because speculative positions can quickly be affected by sudden market shifts.

Speculators mostly make their living out of hope. Benjamin Graham, considered the Godfather of Investors, elaborated on this concept in his book ‘The Intelligent Investor’ and in his 1951 book ‘Security Analysis’. He proposed that the key principle of successful investment lies in stocks or assets functioning like a good business or company. A good business operation should ensure investors’ promises, facts, safety, security, and satisfactory returns. Anything beyond these operations that fails to meet business goals is termed speculative.

Conclusion

In summary, there are three distinct methods for navigating the financial markets: trading, investment, and speculation. Each method caters to a particular risk appetite, time horizon, and purpose. Taking on more risks in exchange for possibly larger profits characterizes speculating. Trading, on the other hand, concentrates on short-term profit. Investing focuses on long-term wealth creation. Individuals must comprehend the differences between these three concepts. This comprehension is imperative for creating sound financial strategies. It is also crucial for accomplishing financial goals in a dynamic market.

Read E-Learning Tutorial Courses - 100% Free for All

Basics of Investing for Beginners

- Chapter 1: What is Investment and its objectives?

- Chapter 2: Why is Investment important for Economic growth?

- Chapter 3: Ways to Invest your Money and Make Profit

- Chapter 4: Best Investment Opportunities for your Retirement Income

- Chapter 5: What are the Legal Matters you should know before Investing?

- Chapter 6: Different Types of Investment Risks Involved in Investing

- Chapter 7: When and How to Invest in Stocks?

- Chapter 8: How Positive Attitude can improve your Investing mindset?

- Chapter 9: Should you Borrow Money to Invest in Stock Markets or Funds

- Chapter 10: 5 Rules of Thumb - To be consider before making Investments

- Chapter 11: How to Calculate Stock Market Returns and Break Even Point?

- Chapter 12: How to Calculate Compound Interest and Simple Interest?

- Chapter 13: Rule of 72, 114 and 144 of Compounding Interest formula

- Currently Reading: What is the Difference between Trading, Investment and Speculation?

- Chapter 15: How to become a Smart Investor or a Successful Investor

- Chapter 16: Tutorial Quiz – Basics of Investing for Beginners Module