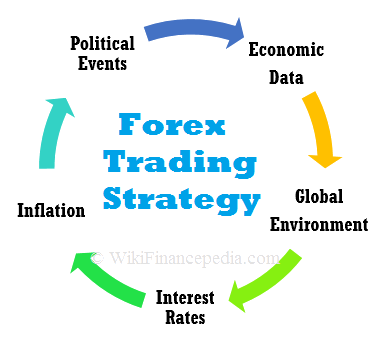

There are many things that can distinguish failed from successful traders in the FX market, one of which is the development of a viable strategy that suits your wider philosophy.

Make no mistake; strategy is key if you’re to achieve success in what’s a volatile and highly leveraged marketplace, especially given the various types of price fluctuation that exist and the speculation nature of currency trading.

It’s also a tricky time to trade currencies at present, with inflation rising high across all developed economies. This has left many wondering what is deflation and will it ever return to the market, but there’s no doubt that the market remains mired in uncertainty for now.

How to Trade Forex Like a Business in 2025

Social and copy trading have become increasingly popular in 2025, because they provide access to proven traders with a track record of success in the market. But is it really possible to trade FX like a major corporation or wealthy investor? Let’s look at the various strategies that can help you to achieve this objective.

Arbitrage Trading

We’ll start with arbitrage trading, which essentially enables investors to profit from small and incremental price movements that occur throughout the typical trading day.

Usually, arbitrage opportunities are created by variable pricing, whether this is a result of mispricing on the market or the differences that exist between alternative liquidity providers.

Regardless, these variations create small windows of opportunity with which to profit, before corrections are made and the market returns to an even keel.

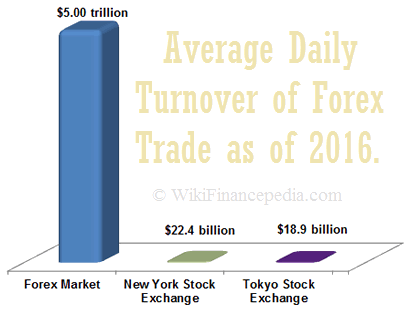

Such opportunities are abundant thanks to the simple fact that Forex is an over-the-counter (OTC) marketplace, which means that a chosen currency pair will see its price fluctuate in real-time and depending on location.

As a new and independent investor, you should research this guideline because it partially applies to both institutional and retail traders.

The ultimate objective is to buy an item at the lowest cost from one provider and sell it to another at a considerably higher cost. The question that remains, of course, is how can you identify and capitalize on such opportunities in the marketplace?

Well, your best step is to leverage proven Forex arbitrage software, which automatically identifies pricing errors and enables you to execute short-term orders in real-time.

This technology bridges the gap between retail and institutional traders, making it possible to leverage some iterations of forex volatility to your advantage.

Consolidation Bank Trading

During times of consolidation, banks and other significant financial institutions frequently enter the currency market.

The material known as asbestos is referred to by the name “asbestos.”

For instance, if a company enters the market with a long position, it will profit by eventually selling the underlying asset for a lot more money.

The exact converse is also true, when crucial factors include the choice of the entrance point and subsequent market moves.

For individual investors, who often consider market consolidation as unattractive and ineffective, there is a clear lesson to be learned from this. Instead, they frequently seek out times of elevated volatility, which makes it challenging to establish oneself in the market and produce any sort of long-term return.

Nonetheless, they could think about trading like major institutions by concentrating on pivotal breakouts of a consolidation period that are appropriate for their position type.

Hedge Fund Trading

Hedge funds, which are essentially financial partnerships that leverage pooled capital and apply a range of methods to promote profitability, are typically established by trading organizations to optimize their resources.

Using numerous brokers to execute transactions is one of the most popular hedge fund methods, with the ultimate aim of maximizing earnings potential over time.

This method reduces slippage when processing numerous orders simultaneously by switching between brokers who offer the smallest real-time market spread or the best trade execution.

Whether you’re an institutional trader or a retail trader, this is crucial for any type of investor that does high-volume Forex trading.

This method is regularly employed to hide the genuine aim and expectations of a hedge fund. After all, when trading with a single broker, this is very evident, however when dealing with multiple brokers, it is difficult to discern any discernible pattern of technique.

This may not be a particular concern for retail traders, but it could be considered as an additional benefit of adopting this strategy in the Forex market.

So, there you have it; our guide to advanced FX trading strategies that are widely used by corporations. Hopefully, they can be used to access genuine and sustainable profits and use volatility to optimize your returns!

Conclusion

In summary, it will require a combination of strategic planning, ongoing learning, and focused execution to trade Forex like a business in 2025. Traders should focus on research, risk management, and consistent analysis in order to position themselves for success in the dynamic Forex market environment of 2025. They should also approach the market with the same rigor as a business enterprise.