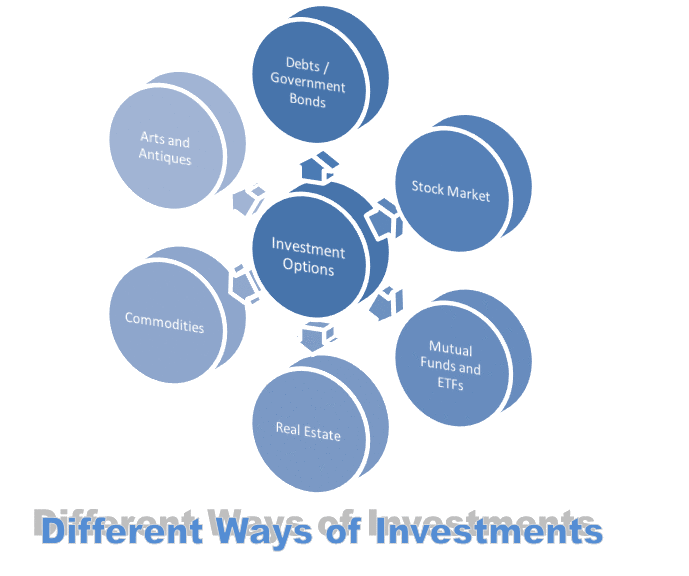

After a few years of investing in mutual funds, an investor desires to diversify his portfolio. Mutual Funds sounded similar to ‘Index Fund’ and ‘Exchange Traded Fund or ETF’. It is important to know the different between ETF and Index Fund as they are comparable in many ways. Let us understand ETF vs Index Fund as to why they sounded so similar to investors.

Active investing and passive investing are the two sorts of investment strategies. Actively managed funds require investors to delegate portfolio construction and management to a fund manager. Essentially, you rely on fund managers to choose the best stocks and make tactical decisions, such as when to buy and sell.

Overview of Index Mutual Funds

Index funds are design to mirror the performance and composition of a fictitious market segment. They invest in assets that mirror the composition and performance of an index. Indexes cannot be purchase directly, but index funds can be. This is a form of passive investing in which you select equities and follow their performance without trying to outperform them.

Tracking funds, including the Nasdaq 100 and S&P 500, have lower expenses than actively managed mutual funds. The best alternative for index fund investors is typically a mutual fund design to resemble an index fund.

Overview of Exchange Traded Funds

Similar to stocks, ETFs are asset pools that are tradable on the stock market. As opposed to mutual funds, which are only price at the end of the trading day, they are exchange on an open exchange, similar to traditional shares.

The costs associated with mutual funds and exchange-traded funds (ETFs) differ. The majority of mutual funds do not impose transaction fees on their shareholders. Taxes and administration fees are lower for exchange-traded funds. Most passive retail investors believe index mutual funds are less expensive than exchange-traded funds (ETFs). However, exchange-traded funds are prefer by institutional investors who are passive.

According to financial analysts, investing in index funds is more passive than investing in value stocks. Both of these investment strategies are consider conservative and long-term. Value investing is typically lucrative for investors who are patient and willing to wait for a bargain. Purchasing stocks at a discount increases the likelihood of long-term profitability. To outperform the market, value investors shun trendy stocks and market indices.

ETF vs Index Fund

ETF vs Index Fund are quite similar. In this situation, investors are uncertain as to which investment product is suitable for passive investing. Let’s examine some examples to illustrate how ETFs vary from index funds.

Different Forms of Liquidity

When you invest in an Index Fund, the mutual fund operator adds your investment to its total assets under management (AUM) and then purchases securities that correspond to the index. In addition, because Index Funds permit redemptions in the reverse direction, liquidity concerns are unnecessary.

However, a lack of liquidity can be problematic for exchange-traded funds (ETFs). Contrary to an index fund, buying an ETF is comparable to buying any other stock share. Consider the following scenario: you wish to sell 100 units of your ETF, but there are currently no buyers. You will be unable to sell any ETF units at the desired price due to the lack of liquidity in ETFs.

However, the liquidity situation in India’s major ETFs is unquestionably improving. Liquidity remains a concern, particularly for low-volume sectoral and smart beta ETFs.

Different Forms of Fund Management Exist

Index funds are passively manage, whereas ETFs can be actively or passively manage. Actively managed ETFs currently account for around 20% of all ETF trading in the United States. In other words, a team of investors does company research and decides how to organise the ETF’s portfolio, which stocks to purchase and sell, etc.

Actively managed exchange-traded funds (ETFs) can be quite innovative. Replicating the diverse portfolios of well-known investors such as Warren Buffett and Rakesh Jhunjhunwala can be used to build an ETF. Cathie Wood owns the ARK Innovation ETF, a technological development-focused mutual fund.

This ETF invests in companies developing DNA technology, industrial innovators, health-tech firms, and Internet enterprises of the future generation. Not all exchange-traded funds (ETFs) are passive, but index funds are often passive.

Different Forms of Expense-to-Revenue Ratio

The expense ratios of ETFs and index funds are lower than those of actively managed mutual funds. Expense ratios are charge by mutual fund companies for managing your money. ETFs are frequently more cost-effective than index funds.

The expense ratio for the HDFC NIFTY 50 ETF, for example, is as low as 0.05 percent, but the expense ratio for the direct HDFC NIFTY 50 Index Plan is 0.20 percent. Depending on your perspective, this is an additional 0.15 percent or a 300 percent premium over an ETF.

However, there are two more costs to consider. Your broker’s commission, also known as the trading platform, is the first of these additional charges. Brokers frequently charge a portion of the trade or a flat fee per transaction. Common commissions or fees include brokerage fees, the Goods and Services Tax, the Sales and Use Tax, stamp duty, exchange fees, and the SEBI turnover tax, among other expenditures.

The bid-ask spread is the second expense to consider when trading exchange-traded funds. Therefore, when comparing the expense ratios of ETFs and Index Funds, these two fees must be included.

Different Forms of Trading Styles

A mutual fund is comparable to an index fund, whereas an ETF is more comparable to a stock. This is because ETFs, like stocks, can be traded at any moment on stock markets. Consequently, ETF prices fluctuate throughout trading sessions.

Index Funds, on the other hand, can only be purchase and sold at a predetermine price at the end of each trading day. It is irrelevant that long-term investors are anxious. Because ETFs provide intraday trading, stop losses, order limits, and other features, they can be highly handy for investors attempting market timing.

Different Forms of SIP Service Availability

SIPs, or systematic investment plans, are a popular investment vehicle for frequent investors, with average monthly inflows of about Rs. 8,000 crore. SIP is permit for index funds as opposed to exchange-traded funds (ETFs).

As the SIP technique remains a very disciplined and stable way for investors to participate in the equity markets, the absence of ETFs is a big drawback. Consequently, if you intend to invest in stocks via a systematic investment plan (SIP), index funds may be your best alternative at this time.

Different Forms of Expenditure Amounts

Multiple purchases of ETFs are typical. To acquire 10 or 20 shares of a corporation, you would need to purchase 1 unit, 7 units, 100 units, etc. of an ETF. Therefore, if an ETF’s unit price is Rs. 40, you must invest in multiples of Rs. 40. Conversely, index funds are often purchased in US dollars. Therefore, you invest 500, 1,000, or 2,000 rupees in an Index Fund.

This comparison of units to dollars affects the minimum investment required to acquire any of these financial instruments. Similar to ETFs, the majority of trading platforms allow investors to acquire a single unit. In today’s money, one unit of the ICICI Prudential Bharat 22 ETF costs around Rs. 40. The cost of the ICICI Prudential Bharat 22 ETF is Rs. 40.

Conclusion

It is essential to differentiate between ETF vs Index Fund. ETFs are believe to be more flexible and convenient than mutual funds, to begin with. ETFs, which are tradable on an exchange like stocks, are more liquid than index funds and conventional mutual funds.