At times it does not cut corners on your purchases since it ends up proving expensive and costing you a lot of money in the long run. Car insurance falls under this kind of purchase. Auto insurance is intended to safeguard you from financial losses in times of a vehicular accident. Therefore, you must be certain of getting the best full coverage vehicle insurance from the most affordable car insurance provider.

Your state may have a minimum requirement for the coverage amount you need to purchase. Full coverage insurance goes beyond these needs to ensure that you are safeguarded against any additional risks. It will pay off if your car is subjected to a collision, hail damage, or anything else.

Overview of Full Coverage Insurance

Full coverage car insurance is considered an insurance policy that moves beyond the minimum requirement for insurance in your state. The cheaper low-cost auto insurance policies will include the liability insurance offering compensation if there are any bodily injuries or damage to the property to other individuals.

A few states also need to buy the no-fault coverage that offers you compensation against any medical issues during an accident, irrespective of who is at fault during a collision. But, there are laws governing the state that does not need you to purchase the insurance premiums to safeguard against the losses the other driver does not cause.

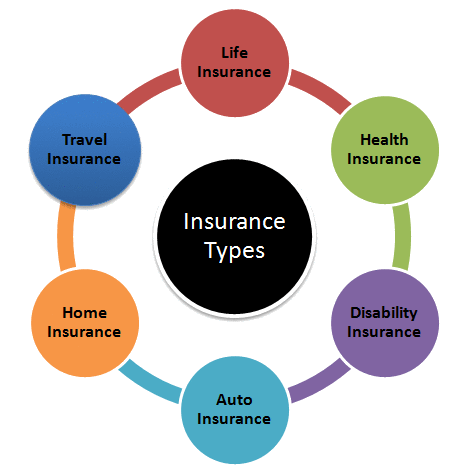

There are two kinds of coverage that are included under the full coverage insurance beyond the minimum one: comprehensive insurance and collision insurance.

Collision & Comprehensive Insurance

Collision insurance provides coverage if you get into a car crash that’s your fault or if you get into a car crash with something other than another vehicle. For example, a collision insurance policy will provide you reimbursement for the repair or replacement of your car if:

Collision insurance offers coverage where you can enter into a car crash when you are at fault or if you crash your car onto something other than the other vehicle. Collision policy will pay for the replacement or repair of your auto in situations where:

- You crash onto another vehicle

- You hit the tree

- You crash into deer

- Your car rolls over onto a curve

The comprehensive insurance will cover you if your car is destroyed, damaged, or stolen while you are not driving it. The comprehensive car insurance will cover you when:

- Your car gets stolen

- Your car is damaged in your garage due to a fire

- Your car is damaged as a result of hail

- A tree falls onto your car

Generally, comprehensive and collision policies will reimburse you for the recent value of your vehicle, excluding the deductible. They never reimburse you for the price it will cost to purchase a new car. However, the policies will cover the repairs if your car is damaged and yet repairable.

Other Insurance Coverage Included

It depends on your insurer that you can get coverage under your state’s regulations, whereas your full car insurance policy also includes additional coverage. It includes underinsured or uninsured vehicle coverage.

But, these are the extra kind of insurance known as the supplemental coverage that requires to be added to need the minimum coverage where your insurance premiums will be higher.

You can carefully check out whatever is included under the policy to ensure that you need every coverage you get to make certain that the added kind of coverage is worth paying for.

Who Requires Full Coverage Car Insurance?

There are a few drivers and several motorists who would need the full coverage car insurance. for instance, you need to avail yourself the full coverage of car insurance when:

You have a high-value car

When the total cost to replace your car is equivalent to about a year or two for the premiums for complete coverage car insurance, you will not require any additional coverage.

You can save on these premium amounts in the savings account for about a year or two instead of paying the insurer. Therefore, you need cash to replace the car if you need it.

You need a car but can’t afford one now

If your automobile were to break down, you wouldn’t necessarily need to be in a financial position to replace it if you required one for work or family duties. You need auto insurance to ensure that you can replace your vehicle in the event of an accident.

You do not own a car completely

If you finance or lease your vehicle, you will almost certainly be obliged to have comprehensive insurance. Full coverage insurance is something you should carefully consider unless you have the funds on hand to pay off the loan in full regardless of what happens to the car.

Final thoughts

The full coverage auto insurance will offer you comprehensive protection if ever there is an issue with your car. You can easily find affordable policies with the help of the most affordable car insurance provider. You need to shop around and get quotes from various companies before making a final choice!