Choosing a well financing sources is actually important for business as well as to take strong decisions by company’s management. A decision related to source of funds impacts a business a lot. In this topic we will look into the sources of finance and sources of funds based on the phase, ownership and group of companies.

In-case of decision related to source of finance is incorrect, the cost of funds increases which in turn would have a direct effect in the feasibility of business activities and projects. A proper type of sources of funds with business requirements could boost earnings and assist in smooth operating of a business.

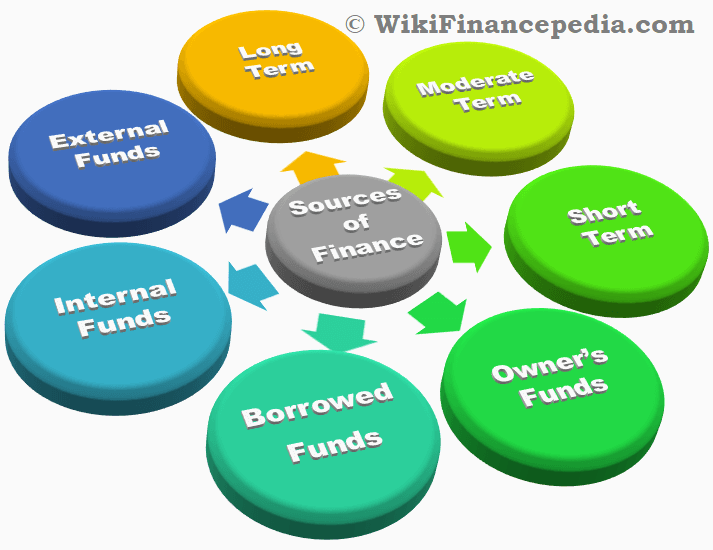

Sources of Finance / Source of Funds

Sources of finance for business are the most search area specifically who are about to begin a new start-ups or small businesses. It’s possibly your most difficult component of all the time and efforts invested for your entrepreneurs. There are various source of funds, we could classify on the basis of parameters. Let’s understand those in detail here.

Sources of Finance – Based on Phase of a Company

Here are some of the sources of finance notes based on phases of the company. Check it out!

Long-Term Source of Funds

The financial need of a business for a period exceeding five years is termed as a long-term source of funds. It offers various sources of finance for business expansion like: debentures / bonds, stocks, loans and long-term borrowings from bank or other financial organizations. Organizations consistently need such financing to procure fixed assets like equipment, plant, machinery, and other essential resources.

Moderate-Term Source of Funds

A moderate-term source of funds is characterized by the need for funds over a period of 1 to 5 years. Your sources associated with moderate term come with lease financing, borrowings from banks as well as financial institution loans.

Short-Term Source of Funds

Short-term sources of funds refer to funds required for a period of one year. For example: Financing from retail banks, trade credit (This kind of credit does not result in the funds but it facilitates buys without immediate payment.), credit cards, etc. are definitely the types of sources of finance for short duration. Short-term financing normally known as just as working-capital financing.

Sources of Finance – Based on Ownership of a Company

Here are some of the sources of finance for small business based on ownership of a company. Check it out.

Owner’s Source of Funds

Business owners generate funds from their capital, known as own funds. These sources of finance may be from sole business owner or perhaps shareholders or partners of a business. Furthermore, it encompasses earnings that the business reinvests. That the owner’s capital stays invested in business for much longer time-frame.

Ideally such source of funds also gains control to management within the business. Some business owners might not always dilute ownership into the business and others may risk of sharing the ownership as well. Retained earnings and equity shares tend to be common sources of finance from where owner’s funds can be acquired.

Borrowed Source of Funds

Borrowed funds, frequently acquired via loans, play a crucial role in financing small businesses and are routinely incorporated into decision-making processes. Various sources of funds include loans from financial institutions, retail banks, commercial banks, trade financing, debenture issuances, deposits from individuals, and more.

These kinds of sources offer money for the specified duration, and also need to repay the loan along with interest after the expiry of time period. These finance options disregard business strategies after providing the loan. Typically, lenders offer borrowed funds by mortgaging the assets of the borrowers.

Sources of Finance – Based on Group of a Company

Here are some of the sources of finance for business expansion based on group of a company. Check it out!

Internal Source of Funds

That finance which is created within business is known as internal sources of finance. For example: the business, create money internally by just speeding collection process concerning disposing to surplus finance, receivables to improving its profit. All interior sources of funds will fulfill just limited financial requirements of the business.

External Source of Funds

External sources of finance include investors, vendors, lenders, and other entities that knock on a company’s doors. When a business requires a large volume of funds, it typically seeks assistance from these external sources. External funds are always expensive when compared to internal sources of finance notes.

Conclusion

For any kind of a business, its primary duty of management and business owners to do well-research on sources of finance notes. Every now and then company may need finance might be for long-term or short-term. You should be well enough to take the right decision regarding source of funds for your organization. If you liked this article, then do provide your feedback in the below comments sections. It will assist other reads to learn more from you.

Read E-Learning Tutorial Courses - 100% Free for All

Basic Finance Concepts For Beginners Guide

- Chapter 1: What is Finance with Examples?

- Chapter 2: What is International Finance?

- Chapter 3: Importance of Finance

- Chapter 4: Features of Finance

- Currently Reading: Source of Funds

- Chapter 6: Types of Capital

- Chapter 7: Types of Capital Market

- Chapter 8: Types of Investment

- Chapter 9: Short Term Sources of Finance

- Chapter 10: Long Term Sources of Finance

- Chapter 11: Finance Quiz – Finance Basics for Beginners