All individual, professional, businessman will have their goals to be in profession or business. however, about objectives at personal finance, we do not plan them. Although, you should know how you can save a lot, how much insurance you should take, people must know their personal goals. Here is the step by step financial planning process which includes six steps in financial planning process which will assist you. You should be aware of the life cycle approach of financial planning process to structure your personal goals.

Life Cycle Approach of Financial Planning Process Example:

Let us take an example of financial planning process to understand. Assume that a person having a monthly income of Rs.1 lakh. He has in mind that around Rs.60,000 will go in expenses and remaining will be his saving. With this typical personal goals in mind just like apartment buy, wedding, upbringing of children’s, then, he begins Rs.10,000 as expenses all month. The actual saving will be around Rs.30,000 per month from salary income. Through this saving he buys the mutual funds or best life insurance plan with the maturity benefit of Rs.25 lakhs after 20 years. But he don’t realize the importance of inflation and calculating the future value required after 20 years. He should actually set the goal of buy a life insurance policy which will give maturity benefit of Rs.1 crore or Rs.2 crores. As expense after adjusting inflation will require that much amount of money to cover his expenses after 20 years.

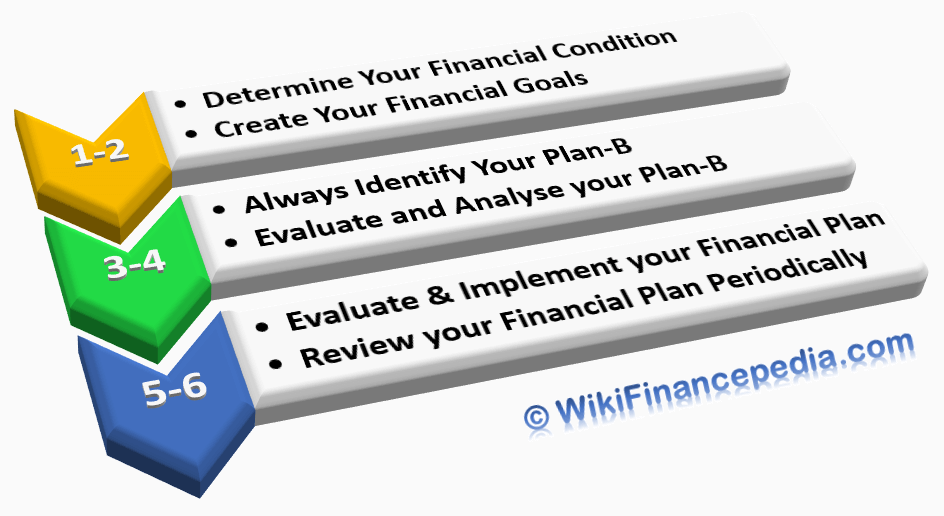

Importance of Six Steps in Financial Planning Process:

A great financial plan takes into account all the aspects of your funds, balancing everything need to desire aided by the personal goals you have got for the future. Here we are going to discuss about six steps in financial planning process with detail analysis.

1. Determine Your Financial Condition:

You might be a salaried individual, an expert or a businessman, check your current financial condition. This is the first and important step out of six steps in financial planning process. It is important that you should ask yourself that where are you now? Do you have enough investment and funds to back your desired goals? Is it true that you are ready to deal with your home loans and personal loans? Is your pay enough to achieve your own financial aspirations? You should be honest and have correct data with you about your financial situation.

2. Create Your Financial Goals:

Now it’s the time where you should start drafting your financial plan to achieve your goals. Before you start building it, you should know what financial goals would you like to accomplish and what will be the time duration for it. Goal like, you wish to retire at the age of 55 years, live a debt free life after 40 years of age, need to travel to another country for further studies, need to allocate funds to buy second home, saving the funds for your child marriage, need to send your child to another state for higher education and much more.

An important objective is to first start building your financial plan, which can give you financial freedom. For example: If you are planning to live debt freedom life at the age of 40 then you should start building a financial goal which will be a road-map for your life achievement goals.

3. Always Identify Your Plan-B:

I trust a few activities like adapting saving techniques, strengthening your relationship with your funds, living positive life and keep inspirational others are the ways in which you can accomplish your financial goals. But it is always advisable that when you prepare your Plan-A as your action item to achieve your goals at the same time you should be ready with Plan-B. This is one of the important steps out of six steps in financial planning process which should be your mitigation plan for all your actions.

4. Evaluate and Analyse your Plan-B:

Think about your present life condition, your own values and your financial factor. Additionally, identify risk and time associated with it for each and every alternative Plan-B action. Here, you should check alternative investment products available in the market and select the best ones as your alternative Plan-B dependent on your goals. You may need to do a few changes in your way of life with the alternative goal to accomplish your financial and life goals which are your life achievement goals and might be your retirement planning goals as well.

5. Evaluate and Implement your Financial Plan:

When you completed all the above four steps in financial planning process s referenced above, you will get a clear vision for your financial goals and what you have to do to accomplish them. Taking first step will be tough as you might not be confident whether your plan will work or not. But it is also true that you will be rewards only when you start taking risk. The plan stays on paper if you don’t execute it. So now it’s time to take first step toward achieving your goals and rest of the steps will automatically follow your actions.

6. Review your Financial Plan Periodically:

As you go ahead and actually execute your financial plan, you should re-examine your plan at regular intervals as a checkpoint towards accomplish your life goals. It is advisable that if you have long-term goals then you should divide your goals into small-small milestones. With this you will be able to keep track of your progress by re-visiting it periodically. For example: You want to invest in best mid-cap mutual funds with the goal of earning minimum 50% return on investment for 5 years. Then you break this goal in year-on-year milestones to keep checking the progress on your milestones periodically.

Conclusion:

It comprises of six steps in financial planning process your will likely help one in assessing and planning your current as well as future financial needs plus developing a better financial plan to match their specific goals. Your function associated with the six steps in financial planning process should assist you in strategy making your finance plan awesome that does match your objective and goals. After this you should start implementing this six steps in financial planning process of your personal plan and let us know, how it worked for you!

Read E-Learning Tutorial Courses - 100% Free for All

Financial Planning Basics For Beginners

- Chapter 1: What is Financial Planning with Examples

- Chapter 2: Different Types of Financial Planning Models and Strategies

- Chapter 3: Importance of Financial Planning

- Chapter 4: Personal Financial Planning Process

- Chapter 5: Benefits of Financial Planning

- Currently Reading: Financial Planning Process with Examples

- Chapter 7: Objectives of Financial Planning

- Chapter 8: Limitations of Financial Planning

- Chapter 9: Financial Planning and Control

- Chapter 10: Financial Planning and Analysis

- Chapter 11: Determine Financial Goals - Assessment, Budgeting and Goal Setting

- Chapter 12: What is Optimism Bias - Definition, Effects on Financial Decisions

- Chapter 13: What is Personal Financial Planning? Examples and Templates

- Chapter 14: What is Business Financial Planning? Means, Examples and Process

- Chapter 15: What is Financial Planner? Definition, Steps, Scope

- Chapter 16: Your Rights and Responsibilities as a Financial Planning Client

- Chapter 17: Strategic Planning and Execution of Financial Plan

- Chapter 18: Why Emergency Personal Financial Backup Plan is Needed

- Chapter 19: Top 10 Common Errors - Worst Financial Mistakes to Avoid

- Chapter 20: Basics of Financial Planning Quiz - Question and Answers