Once assessment is done and all the current financial facts are on the table, then one can start making plans. In order to give plans a direction; there is the utmost importance of setting goals. Working without a goal is like walking / travelling without having a destination. So, setting goals of financial management is such an important thing. In this e-learning we will discuss and understand about budget, objectives and financial management goals.

People get failed in setting goals of financial management correctly because of the basic human nature of acquiring more and more. In that pulse, generally, people set higher goals which they cannot meet in the reality. Example of financial management goals: say someone set a goal of creating a wealth of 100 billion dollars while currently monthly income is ten thousand dollars. Once such an impractical goal is set, that person starts feeling the burden of it, and things start appearing overwhelming.

Goals of Financial Management for an Organization

There are primary 2 goals of financial management for an organization, company or business. These goals are profit maximization and wealth maximization. Today in this financial management tutorial we will understand more above it.

Maximizing Revenue Goal

Maximizing revenue goals means that appropriate financial actions and decisions will increase profit earning as well as assist in minimizing unnecessary and unwanted expenses. It is the primary duty of financial managers and financial supervisors to select right assets.

Projects that are achievable and profitable and should be sound enough to reject those projects which are not in the goals of financial management. Since maximizing profits are the primary goals for an organization, but this goals are criticized in today’s business world. This is mainly due to reasons like: Ignoring benefits of time value, Ambiguity, Ignoring benefits of quality product, etc.

Maximizing Shareholders Value

Maximizing shareholder value relates that your managers should take appropriate decisions to optimize the value of a company. The worth of the company is sum of the equity and debt market value. Debt holders posses fixed claim to a company. Therefore if worth of a company is maximized, the market value of a company’s equity will also increases.

This means that shareholder will earn more profits from the growth of an equity value. This goal is considered to be superior than the maximizing revenue goal. This is mainly due to reasons like: Benefits of quality product, clear and definite goals, reduces conflicts towards shareholders interest, etc.

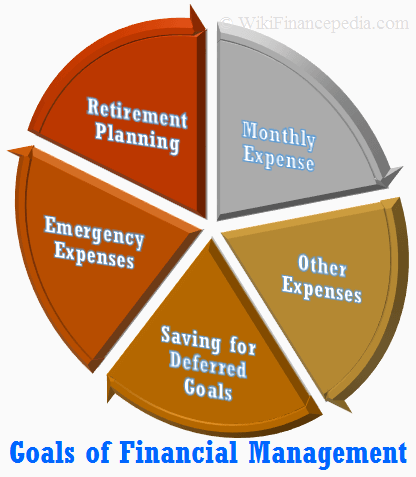

Goals of Financial Management for Individuals

In this we will learn about what are the primary goals of financial management for individuals. Every person has a different goal of financial management since aspiration of the personal differ from person. But there are common basic goals of financial management which everyone should meet in life.

Monthly Expenses (Monthly Budget)

It is simple as that. One just needs to make a list of all the expenses which he needs to pay in a month. The list should include the expenses of shopping, medical, weekend quick enjoyment trips; take care of parents, etc. along with the main expenses.

Here thing to note is in general, expenses are almost always more than expected (miscellaneous expenses). So, add 20% to the total amount of your whole monthly expense list. This extra amount will cover those expenses which people do once in 2-3 months like buying some random gift for your loved ones.

Once in a While, Other Expenses

These expenses are like buying a car, a laptop, home repair, vacations, buying appliance etc. In order to cover these expenses people generally leave some cash in their accounts (or at home), let these minor savings grow a bit, and then purchase.

Savings for Deferred Goals

Every person have some future needs, like buying a home, higher education of children, their marriage etc. These expenses are quite heavy (E.g. – home), so one has to keep on accumulating funds for the same. The savings should be generally in the form of insurance, property investment, mutual funds, bonds, shares, fixed deposits (though FDs are now getting obsolete because of their low rate of interest).

Emergency Expenses / Requirement

Unseen future needs like hospitalization, theft, death, natural calamities etc. People need insurance for the same as a plan “A”. But what if plan “A” fails? There should be a plan “B” as well. So, it is always better saving in more than one thing. People do keep on saving in multiple things like property, mutual funds, insurance, shares, etc.

Life Time Goals: Retirement Planning

These are the final goals of financial management for your old age i.e. retirement. It is not advisable to live on the expenses of your children. People don’t prefer it at all. So, they keep their retirement plans on high priority.

These general expenses are financial goals. In fact, the above listed expenses are necessities (minimum achievable goals). It is always advisable to set goals higher than the bare needs.

Allocation of Funds

Next comes is the working on financial assessment documents. There is a need of making a plan in such a way that with the help of current income and estimation of future income can meet all the set goals.

The allocation of future personal income towards expenses, savings and debt repayment is called budgeting. When working on your goals of financial management or allocation of funds few important things should always kept in mind. Some of them are:

Flexibility in Budget

It is sure that budget will change every month; more or less, but it will change for sure. So, a monthly review is required. And example – if a family spend Rs. 2, 000/- more on something after best efforts, then next month the budget should be increased by this amount.

Irregular Income Management

There are high chances of running out of money even when earned money is same. Also, there are high chances of spending more money than earned amount. So, these 2 pitfalls are major of those families where income is irregular. This thing happens when earning is coming from profession or some business (not salaries). So, it is utmost important to establish some backup money to handle the situations where expenses go beyond the earned amount in a month.

The 60% Solution

One of the editor-in-chief, Richard Jenkins has created a budgeting system called “The 60% Solution”. Basically, this is a suggestion to allocate maximum 60% of earning to fixed expenses like monthly expenses, regular bills, insurance etc. And remaining 40% should be allocated to long-term savings, retirement, irregular expenses, entertainment etc.

Conclusion

In this chapter we have describe the goals of financial management. The goal setting and budgeting is critically important to regulate the finance. But it is even more important to follow the budget strictly. It requires lot of discipline and self-control. Actually, a whole motivation book could be written around it. And exactly this is the key to success in life. Anyone can make the plans or set goals of financial management but only those who execute the plans become successful. Hope this points will help you to set proper goals and execute it wisely.

Read E-Learning Tutorial Courses - 100% Free for All

Financial Management Basics For Beginners

- Chapter 1: What is Financial Management with Examples

- Chapter 2: Importance of Financial Management

- Chapter 3: Objectives of Financial Management

- Chapter 4: Functions of Financial Management

- Chapter 5: Types of Financial Management

- Chapter 6: Nature and Scope of Financial Management

- Chapter 7: Investment Valuation and Project Valuation Methods and Techniques

- Currently Reading: Goals of Financial Management

- Chapter 9: Financial Management Process

- Chapter 10: Financial Management Notes

- Chapter 11: Financial Management for Startups

- Chapter 12: Financial Management for IT Services

- Chapter 13: Financial Management Quiz - Question and Answers