Corporate finance is associated with that the corporations and also the financial decisions being taken within corporations. Generally, there are countless relevant principles concerning corporate finance and various functions of corporate finance which plays a role in these corporate decisions. Corporate finance is one of the most important topics within the financial domain. One of the important functions of corporate finance sector is to cost benefit analysis. This concept can be use towards find out total input at the best project plus the results of undertaking project. Financial evaluation normally one of the significant concepts concerning corporate finance.

Corporate financing managers/specialists conduct this research. They employ financial research to assess both the stability and profitability of a particular business venture. Subsequently, they utilize financial ratios, which are also known as accounting ratios. Widely employed by managers, shareholders, and analysts across various sectors within the finance industry, these ratios serve as a common financial metric. They are instrumental in evaluating the financial condition of specific corporations. That financial ratio normally used for that the cause to achieving comparisons around companies with regards to demerits as well as merits of their financial security and stability.

Functions of Corporate Finance

Corporate financing utilizes these significant functions to mitigate the financial risks faced by the corporate sector. Moreover, these concepts serve to enhance the profits of corporations. They can be applied to analyze and resolve financial difficulties for almost any company.

These crucial concepts in corporate finance guide investment decisions for both the long and short term simultaneously. All choices which are pertaining to that the capital investment is long-term decisions and working capital handling are termed like short-term move. Here are some of the key functions of corporate finance mentioned below:

Separation of Management and Ownership

One of the basic functions of corporate finance is actually the separation of management and ownership. This time, that the company is not really restricted by just capital typically provided by an owner / founder only. The general public requires ways for investing their extra money. They’re not content of placing all their funds in risk free accounts with bank.

They would like to take a calculated risk with some of their money. It is because of this reason that money areas come with emerged. That they serve their dual require to offering corporations with supply of funding whereas in addition they offer their people having a range of choices concerning investment and returns on investments.

Collaboration between Capital Markets and Company

Functions of corporate finance looks just like a collaboration around each company as well as with capital markets. The function of financial manager along with other expert’s professionals within the corporate finance domain are two folds. Firstly, they have to make sure that the company has adequate funds which they’re using the best sources of funding that have that minimal costs.

Next, they’ve to make sure that that company is actually placing each funds appropriately and also creating best returns on investments for its corporation. These two decisions are that the primary functions of corporate financing in every company.

Finance Decisions

Considering that company now has access to capital market for fulfill their funding specifications. But, their company confronts numerous options about funding. That the company could firstly decide whether that it wants to increase debt capital or perhaps equity capital. Even there are various choices when selecting either equity or debt capital for a company. They may choose corporate loans, public fixed deposits, bank loan, debentures to raise capital from the market.

Financial innovation then secularization, has provided vary of instruments your company can easily use to increase capital. The functions of corporate finance manager so are promising that the company has possible capital and appropriate capital structure. They have each appropriate combination concerning equity and debts along with other financial devices.

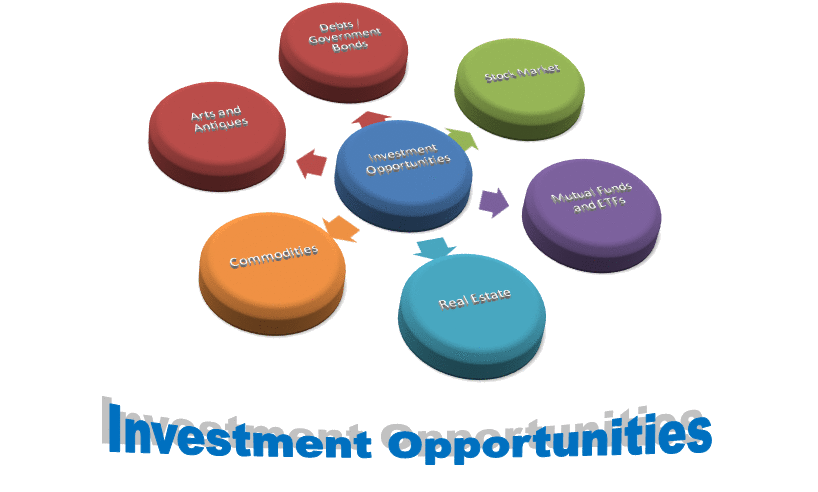

Investment Choice

When the company has raised required capital from various sources, their financial manager deals with the following big move. Your decision is deploy that the funds in a manner so it yields the best returns for shareholders. Company needs to be aware of its cost of capital. After that they see their cost of capital, they can deploy his or her funds in a way that each returns in which accrue are more than the cost of capital which the company maintains in order to pay.

Looking for these investments plus deploying each funds effectively your investment decision. It’s also recognized when cost management and it is a fundamental functions of corporate finance. Money cost management possesses theoretical presumption that the company has access toward unlimited financing as long they’ve feasible projects. the difference of this choice was capital rationing.

Investing and financing choices is like two different sides of the identical coin. Your company must raise funds only when it’s ideal avenues to deploy them. The functions of corporate financing have varieties of equipment as well as methods that allow supervisors / managers to evaluate funding plus investing choices. It’s thus essential for the financial stability and growth of the company.

Acquisition of Resources

Acquisition of resources suggests fund generation on cheapest possible ways. Fund resources generation is actually available through two groups. Liability (This consists of warranties out of bank loans, goods, as well as payable account.) and equity (This includes money from retained profits, investment returns or selling stocks.)

Allocation out of Resources

Allocation of resources means is actually nothing and yet investment funds concerning income / profit maximization. Investment is categorized in 2 groups. Fixed assets (Land, Buildings, Machinery etc.) and current assets (receivable accounts, cash, stock, etc.) Broad functions of corporate finance tend to be: Budgeting of Capital, Financial Management, Raising of Capital or Financing, Risk Management, Corporate Governance and more.

Conclusion

Out of all acquisition of resources and allocation of resources are two primary functions of corporate finance. After getting corporate finance there is a big role of finance manager or finance department in every company to make optimize use of those resources. Here we have understand the key functions of corporate financing and hope this would be helpful in your day to day life.

Read E-Learning Tutorial Courses - 100% Free for All

Corporate Finance Basics For Beginners

- Chapter 1: What is Corporate Finance with Examples?

- Chapter 2: Objectives of Corporate Finance

- Chapter 3: Importance of Corporate Finance

- Chapter 4: Types of Corporate Finance

- Chapter 5: Principles of Corporate Finance

- Chapter 6: Sources of Corporate Finance

- Currently Reading: Functions of Corporate Finance

- Chapter 8: Nature of Corporate Finance

- Chapter 9: Scope of Corporate Finance

- Chapter 10: Corporate Finance Quiz - Question and Answers