The length of time it takes to transform net current assets and current liabilities (such as acquired shares) into cash is refer as the working capital cycle (WCC). A protracted cycle results in capital being lock-up without producing a return for a longer period of time. Your business may be more adaptable and free up cash more quickly with short cycles. Let us look at working capital cycle definition with examples and Operating Cycle definition with examples along with formula in this topic.

The working capital / operating cycle are believe to protect distinct phases of a company; each phase requires cash to manage. Business duration gap in between that the investing cash for the raw materials, making finished goods, selling to debtors and receiving cash from debtors is actually recognize as a working capital cycle or operating cycle. Based on the type of your business, length of working cycle varies. It is the responsibility associated with the finance manager to shorten their length of this cycle.

What is Working Capital Cycle?

Working Capital cycle defined as a duration taken by a business to convert their current liabilities as well as current assets into cash. It reflects their effectiveness and capability associated with the business to handle its short-term liquidity position. In other words, the duration of their cycle in order to complete the cycle is refer as the working capital cycle (WCC) or operating cycle.

If the working cycle simply too long, then capital gets locked in WCC without receiving earnings on goods sale. That is why, your business should try to shorten their operating cycle as much as business can, to enhance the short-term liquidity condition and increase their business efficiency.

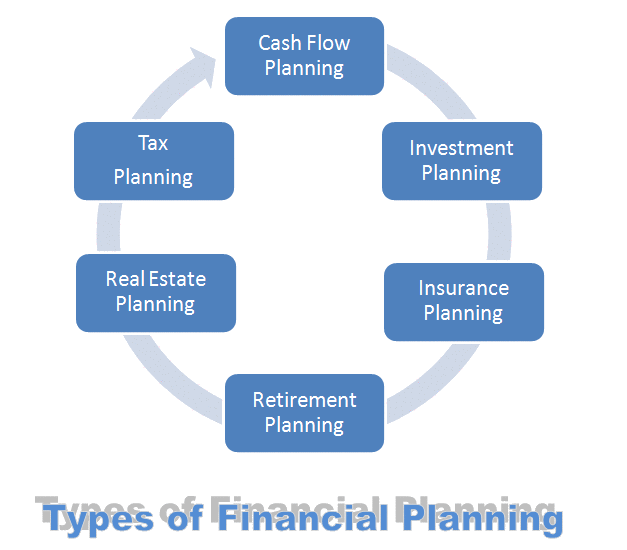

Working capital cycle management primarily focus on four key elements i.e. cash / money, payables / creditors, receivables / debtors and inventory / stock. Business need to maintain total control on these four things to have an effective working cycle.

Working Capital Cycle Example

Let us view an example of working capital cycle or even you can say as example of operating cycle in order to understand the concept of it. For an example purpose, let us assume that Payables Payment Period (PPP) is 30 days. This means, business purchases raw materials at 30 days credit period.

Example of Average Payable Period (APP)

Assume that ABC company sells furniture. Company reported Rs.2,00,000/- cost of good sold and the remaining inventory is of Rs.5,00,000/- at the end of the year. This means that company’s inventory turnover ratio is 0.4 times (Rs.2,00,000 / Rs.5,00,000).

Your company takes raw items on financing and has to pay their lenders / creditors in 30 days of period. This is also refer because typical payables duration.

This means that the business enjoys the credit period of 30 days in the purchase out of raw materials used for their production. It takes time the business in order to convert their financing product sales in to money as a result of the financing management plan integrated with the business

Average Payable Period Formula = Inventory Turnover Ratio x 365 Average Payable Period = 0.4 times x 365 Average Payable Period = 146 days.

Example of Average Collection Period (ACP)

Let us continue with assuming that ABC company had an average accounts receivable of Rs.40,000 during a year. In addition, company had Rs.4,00,000/- as a credit sales.

Let us calculate accounts receivable turnover ratio, which is Rs.4,00,000/- divided by Rs.40,000 is equal to 10 times per year.

Average Collection Period Formula = 365 / Accounts Receivable Turnover Ratio

ACP (Average Collection Period) = 365 / 10

Average Collection Period = 36.5 days.

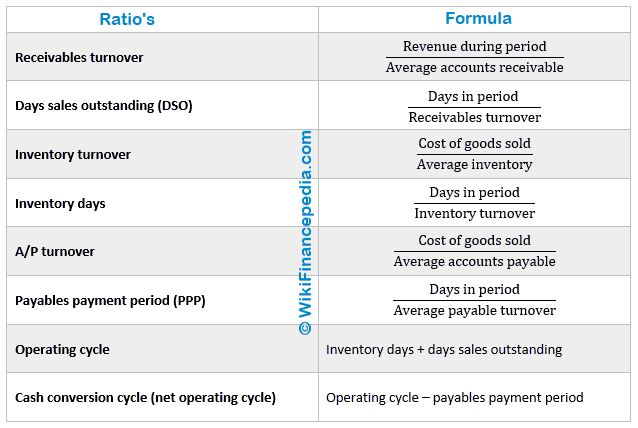

Working Capital Cycles Formula

Let us see, the formula to calculate working capital cycle as mentioned below:

Working Capital Cycle Formula = Average Payable Period + Average Collection Period – Payables Payment Period.

Or you can even say it as,

WCC Formula = APP + ACP – PPP.

Working Capital Cycles Calculation

Let us see how to calculate working capital cycle of a company from the above-mentioned formula.

WCC = APP + ACP – PPP

WCC = 146 days + 36.5 days – 30 days Working Capital Cycle = 152.5 days.

What are the Reasons of Longer working cycle?

Working capital depend on your operating cycle. It begins from purchasing raw material till payment receivables from the debtors. Their duration for the working cycle varies with the nature of business.

- Working cycle may be much longer if the availability of raw goods / materials is perhaps not straight-forward. Due to which, an organization need to maintain adequate raw materials.

- Your processing period i.e.. Converting raw material to finish goods might be much longer. It looks like your product passes through various stages, departments, processes to get complete.

- May be your product is categorized under slow-moving goods. In such instance, time taken to convert finished good to sale will likely be much longer.

- It may be your credit policy as well as difficulties in debt collection also result in increasing your working cycle.

Ways to Reduce WCC

Each business aim to keep their working cycle as short as possible. The shorter operating cycle can be accomplish simply by targeting specific aspects of it. Your company can easily aim towards shorten their operating cycle. Let us notice how it works:

- Reducing the number of credit days to their customers. This will parallel impact on decreasing Average Collection Period (ACP). This can be achieved by giving cash discount on early payments.

- The business should improve its manufacturing process with various techniques to decrease inventory to sales conversion period as well as increase sales. More stock clearance will result in better operating cycle.

- Asking to increase credit days on purchase of goods from suppliers. This can be easily achieved by the companies who have established well know and reputed brands.

Conclusion

This would have assisted you to understand what is working capital cycle with examples, formula, calculations and more. Here you can find the ways through which you can shorten your working cycle as well. This would really be interesting and useful, if your business has longer operating cycle.

Read E-Learning Tutorial Courses - 100% Free for All

Basics of Working Capital Management for Beginners

- Chapter 1: What is Working Capital Management?

- Chapter 2: Importance of Working Capital Management

- Chapter 3: Objectives of Working Capital Management

- Chapter 4: Types of Working Capital

- Chapter 5: Components of Working Capital Management

- Currently Reading: Working Capital Cycle

- Chapter 7: Working Capital Finance

- Chapter 8: Net Working Capital

- Chapter 9: Working Capital Requirement

- Chapter 10: Working Capital Management Quiz For Beginners