Are you looking forward to know the main sources of business funding and how to choose the best to start your business? Then you are at right place. Let’s assume that by now you’ve chosen your business idea and you have very clear commercial, technical, economic and financial aspects of your entrepreneurship project and is time to take a big step: get the money to start. Choose the sources of business funding for a company or a startup is a crucial issue that will define much of the success of the business. There are different ways to raise business funding to start a business, and you can’t say that one is better than another, just say that each one is different and you must choose which conforms to the characteristics of your interest.

Facts to be Consider Before Looking for Your Startup Funding:

Before you choose the way that you will finance your new business, it is necessary to draw up a financial plan that shows you how much money do you need? What, where and how will you invest money wisely? What is the average time for business to become profitable? What will be the profitability of the business?. in short, all the financial and economic aspects must be clear. Once you have done this you will know what is the source of financing that best suits you, so you must consider 3 key aspects:

- The cost of capital.

- The scheme for reimbursement or payment (term, form, interest, etc.).

- The amount of money you can get in a particular.

Well, now we are going to learn about the different ways of fundraising ideas that you can find. Make a list of those that you can access and then choose the most suitable.

Top 10 Best Fundraising Sources for Startup Business Funding:

Here we are going to discuss about most profitable fundraising ideas. There are many different ways of raising funds for example: crowdfunding, angel investors, startup funding website, government business funding, business funding grants, etc. Point here is to select which best suits your requirement. Let us look into details about this.

1. Capital and Own Resources:

Start by looking at your pocket. The equity financing is the most used form of business funding for most small business owners. It is possible that the money that account is insufficient, however, it is helpful to make the most as a resource possesses. Any table, computer, or you can use space will serve to reduce the initial investment. Also, remember that entrepreneurs like Steve Jobs started in the garage of their home or in a dorm, and were able to sell their precious belongings, such as cars, in order to complete the necessary resources to start your business.

2. The 3 “F” (Family, Friends and Fools):

The next place to look for money is your closest circle: “family, friends, and fools”. The big problem with this source of business financing is that generally it can cause conflicts with those who provide capital to access, however, is (relatively) easy access to it and can reach good agreements with them. If you have clear all the resources that you need and you’re well organized, this option may be helpful to start a small business.

3. Corporate Credits and Loans Bank:

The two above options are perhaps easier access, and may be the best for a small business, but your project requires higher investments, inevitably you will have to resort to the financial markets. Financial institutions are a great choice, provided you’re willing to learn some basics about finance. It is very important to know about interest rates, ROI and other indicators that you will serve as a reference for evaluating options offered by banks.

Remember not to go to a single bank, look in the cost of capital and the benefits that offer you various entities and compare. Oh and always read the loan document very well and, if possible, advise from an expert in finance because the small letter and the technical terms are often confused.

4. Government Assistance Programs:

Each government has its own programs to support entrepreneurial culture, providing training and financial resources for the economic development of the region. These tasks are performed through institutions responsible for assessing business and production projects, to select those who meet the requirements for access to aid.

Most of these programs don’t even charge interest by capital, or simply not paid the money if the project meets certain requirements related to the offer of employment in the locality or contribute to the development of the region. The major drawback of this type of business funding is that because it was public entities, and it can take enough time winning their support. In addition, the paperwork is excessive.

5. Entrepreneurship Competitions:

There are entities, both public and private, that organize various events and contests looking for innovative ideas and projects with the potential to support them. Business schools, several accelerators, public institutions organized this type of competition. I’m not encouraging because you grant to another the power to decide your project is good or not. I believe that that only your customers can decide it.

6. Business Angels and Venture Capital:

So far we have seen options where the source of investment does not seek a direct participation in the business, but we arrived at one of the best options when you have a large project whose initial investment is relatively large.

The angel investors are private owners of a great capital and are looking for investment opportunities to pay their money. Convince an investor trust in your project is not an easy task, however, when you get it you get not only business funding for your startup, but also his experience to successfully develop your project.

A Business Angel want to stake in the business, but remember very well structured capital of your new company, otherwise could fall into the error of giving too much power to third parties losing control of your own business. Another disadvantage is that, in general, an investor does not have the same passion as you for business, only you are interested in seeing your money to multiply and could put great pressure on you to demand results.

7. Get a Sponsor For Your Startup Funding:

Start-up a project using a sponsor means that the entrepreneur is financed by a third party related to the activity. There are companies with Social responsibility programs oriented to the business development of the region where they operate.

Having the backing of a large company is an invaluable aid to start a business, only a matter of present a good project to a brand, showing the advantages that you would support our business. For this option, the terms of relationship is highly important and must be set very clearly otherwise the dependence on the sponsor can be lethal.

8. Financing with Suppliers:

This form of financing does not work for any company, is more effective in business marketing activities. Suppose you’re going to start a marketing business of clothing. You make a list of suppliers and negotiate with them so that they provide you within 90 days for the payment of the goods. These 90 days are the time you have to sell and pay providers the debt.

If you manage to establish a good business model will be able to work with the capital of your suppliers, and won’t have a problem to keep the level of adequate inventory to meet the demand of the business. If you opt for this source of business funding it will be very useful to know and implement, Just in Time to reduce your costs and maximize suppliers.

9. Issue of Shares:

The stock market is a great source of business funding to start large business projects. Each country (or most) has its own stock market, their entrepreneurs gather in search of money to undertake business and investors with capital to finance projects.

To access this capital, you must meet certain legal requirements, for example, not any kind of trading company has the ability to issue shares, and, therefore, it is recommended that you check the commercial legislation of your country. Also, I recommend you check this guide for concepts on actions.

10. Start a Business without Investment:

Did you know what you can start a business without capital? Some businesses of this type are for example Internet-based service companies. As it is, it’s a business model that works for companies with 3 features:

- Requires a minimum of investment in fixed assets and inventory of goods.

- With few operational losses (or be reduced to a minimum).

- Whose accounts receivable are to the shortest time possible and accounts payable are the possible longer.

Read E-Learning Tutorial Courses - 100% Free for All

Startup Basics for Beginners

- Chapter 1: What is a Startup? Definition, Examples and Startup Operations

- Chapter 2: What are the Startup Requirements? Checklist and Feasibility Analysis

- Chapter 3: What Is Lean Startup? Definition, Examples, Process and Limitations

- Chapter 4: Top 10 Key Benefits and Reasons to Start a Business

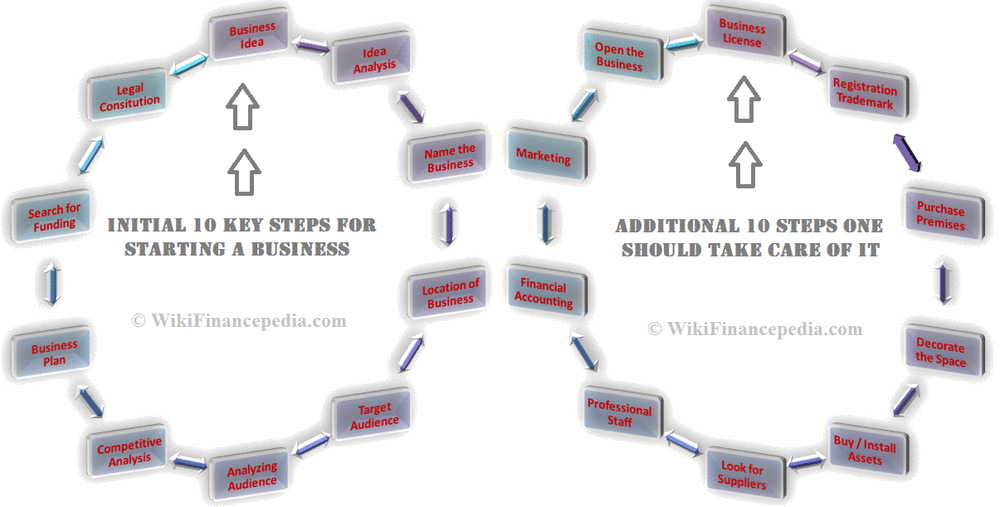

- Chapter 5: How to Start a Company or a Business – Step by Step Guide

- Chapter 6: How to Master in business fundamentals? Basics Guide of Startup

- Chapter 7: Top 10 Best Startup Ideas with Low Investment

- Currently Reading: Top 10 Best Sources for Startup Business Funding for Your Idea

- Chapter 9: Legal Formalities - How to Register a Company or a Startup in India?

- Chapter 10: Top 10 - Best Tactics on Lean Management Strategy

- Chapter 11: How to Analyze Your Startup Business Plan with SWOT Analysis?

- Chapter 12: Best Ways - To Build a Successful Startup Plan and Strategy

- Chapter 13: What is Power of Crowdfunding for Startups and Business?

- Chapter 14: Basics of Startup Quiz – Question and Answers for Beginners