In the previous chapter we have learned about definition of debt financing and few of the examples of debt financing. In this chapter we are going to learn about advantages and disadvantages of debt financing. Here we will be more specific to the topic and will be explain debt financing pros and cons in detail. I would suggest also reading about equity financing in next few chapters before taking any decision. After reading these complete chapters you will be in good position to take the decision. You can decide whether you want to proceed ahead with debt finance or equity finance. I hope below you would get appropriate information about what you were looking for. Do write us your feedback on advantages and disadvantages of debt financing or debt financing pros and cons to assist other readers as well.

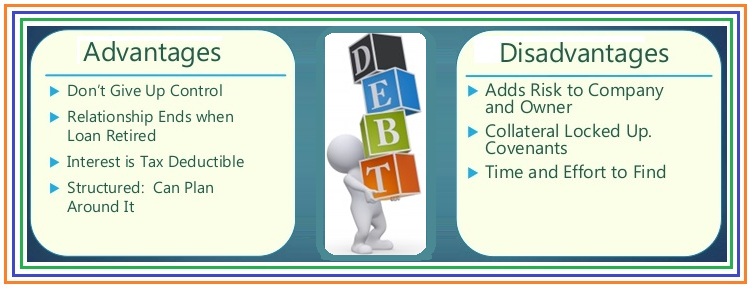

Advantages and Disadvantages of Debt Financing

Here in this article we are going to list down few of the important advantages and disadvantages of debt financing. This will help you to better understand debt finance. This chapter of debt financing pros and cons will guide you to right step toward growth of your business or startup company. Wish you all the best for your success in advance.

Advantages of Debt Financing:

The most fundamental advantage of debt financing when comparing with equity financing is that the loan specialist does not take any part of your equities share in your business – you hold complete ownership and the bank has no power over the running of the business. Whereas in equity financing the equity financing turn out to be part owners of the organization and thus they have rights to object in any of the business management decisions. For example: Angel investors as they prefer equity financing to startup companies.

What are advantages of debt financing over equity financing? Here we are going to break down few of the important notes which are categorized under advantages of debt financing:

1. Retain Control to your Business: When you confirm to raise funds through debt financing from an institutional lender or commercial lenders, the bank / lenders has nothing to do with how you deal with your organization. You have full control on your business. The business relationship with lender closes once you have reimbursed the credit amount along with full interest.

2. Tax Advantage: The sum you pay as an interest to the lender is tax deductible as an operational expense and on account of long term debt financing, the reimbursement time frame can be extended too many years, diminishing the monthly cost. This is one the advantages of debt financing, it’s a well-known techniques for business planning, budgeting and adequately it reduces your net obligations.

3. Easy for Business Planning: When you know well ahead of time precisely how much interest and principal you will pay back as an installment every month on month basis. This makes it quite comfortable for business owners to make budgetary arrangements.

Disadvantages of Debt Financing:

The major disadvantage of debt financing is that any financial lenders like: banks require assets of the business as a mortgage for assurance for the loan. In the event that (as is regular with independent companies) the business does not have adequate security the bank will require some kind of guarantor from the entrepreneurs. Been an owner, this becomes an additional burden of repaying back to the lender on timely basis. By any chance that your business is in trouble and can’t make the installments, whatever individual assets you have posted as guarantee (for example: house, car, etc.) can be seized by the bank.

Every good thing has constraints, limitations and drawbacks along with it. One should very well understand the debt financing pros and cons before applying for it. Here we are going to list down few of the important disadvantages of debt financing notes:

1. Pre-qualification is Mandatory: To apply for a loan, one should require a positive credit rating to get debt finance. In case your business needs debt financing, one have to showcase core statements of business which is again one of the biggest disadvantage of debt financing. One have to present a strong strategy for success set up before any loan specialist or lenders or bank to consider for raising the fund as a loan. This incorporates the income statement of your business, income projections, and balance sheet.

2. Timely Installment Payments: You’ll need the money related discipline to make reimbursements on time. One should exercise great financial judgment when you opt for debt finance. A business that is excessively rely on debt financing could be categorized under high risk business operations by potential investors, and that could create a wall of restriction in-case you wish to raise equity finance in near future.

3. Assets under Collateral: Upon agreement with lender on debt financing, you give assets to the bank / lender, you could put some business resources at high risk. You may likewise be asked to provide personal guarantor by putting your own particular resources on risk. With debt financing, the settled installment plan provided by lenders and the high cost of loan repayment terms and conditions can make it troublesome for a business to grow potentially.

Read E-Learning Tutorial Courses - 100% Free for All

Basics of Debt Financing and Equity Financing for Beginners

- Chapter 1: What is Debt Financing with Examples?

- Chapter 2: Types of Debt Financing

- Chapter 3: Sources of Debt Financing

- Currently Reading: Advantages and Disadvantages of Debt Financing

- Chapter 5: What is Equity Financing with Examples?

- Chapter 6: Types of Equity Financing

- Chapter 7: Sources of Equity Financing

- Chapter 8: Advantages and Disadvantages of Equity Financing

- Chapter 9: Debt Financing vs Equity Financing – Advantages and Disadvantages

- Chapter 10: Debt Financing Quiz – Equity Financing Quiz - Questions and Answers