Income earners today are on a new rat race; early retirement has become a new ideal. A good 41% of millennials plan to retire once they have hit their savings goals. It is only a mere 28% of them that look at age as a prerequisite for retirement and get financial freedom for next 20 years.

The Fall 2018 Merrill Edge Report, notes a very changed view of Americans as whole towards retirement. The greater masses predict that in the future, the retirement age will change more than any other aspect of life.

The FIRE (Financial Independence Retire Early) Revolution:

The emergence of the FIRE (financial independence, retire early) gospel is a testament to the fact that millennial’s have found the retirement equation wanting. There is an almost universal sense of urgency that is making financial planning for the future now, a priority.

Many millennial’s are now trying out all sorts of FIRE lifestyles, ranging from lean FIRE (very frugal lifestyles) to fat FIRE (more balanced). The financial ideals at play look very good on paper.

In an age of stagnant wages, high debts and dead-end jobs, however, saving for the future is a huge challenge. It is possible however to set your finances up for the next two decades and get financial freedom for next 20 years and have incredible financial health in the future.

12 Steps – How to get Financial Freedom for Next 20 Years:

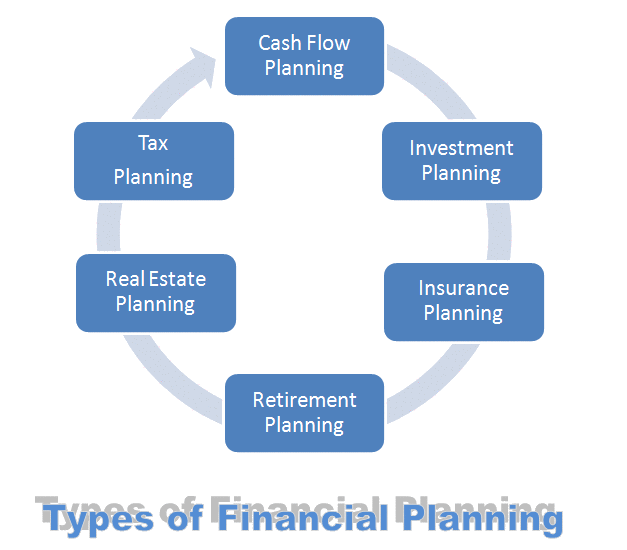

1. Make a Plan:

In his book, ‘The 7 Habits of Highly Effective People’ Steven Covey advised that the key to planning is to ‘begin with the end in mind.’ It is the first step to long term financial freedom. So whip yourself a good cup of coffee, sit down, get a pen and paper or app and get planning.

Go through your financial facts. How much debt are you in? Do you have a working payment plan? How much is the interest rate? Are you saving? Write all these facts down.

Stewart Welch of The Welch Group says that “a written plan forces you to do something.” If you get into grips with your current financial situation, then you will start making decisions that benefit your future.

Proceed to the next step and make a short term and a long term financial plan. Your first short term goal can, for example, be to get rid of all high-interest debt. An excellent long term plan can involve savings and investing.

Remember your early retirement dream? Put it down here and flesh out ways to get to this goal. Put all your short term, and long term plans down so you that you can keep assessing your progress.

2. Make a Budget:

If you want your plan to succeed, then you will need a budget. Budgets are essential spending plans that will show you how to allocate your money to meet your goals. The ultimate goal of your budget should be to assist you to spend less than the income you receive.

NerdWallet’s Kimberly Palmer advises everyone looking to make the best to get financial freedom for next 20 years, to institute a 50, 30, 20 budget. A half of your income should be used to pay for your basic needs. This is the money that should pay for rent, utilities, groceries or gas.

Your wants should be catered to with a 30% of that income. Remember wants are not needs, and if you need to save more, this is the amount that you could use to set you on an upward financial trajectory.

The remaining 20%, is money that you should funnel to your savings accounts or pay off debts. Budgets have taken a bad rap over the years. Many people view them as agents of deprivation. Far from it; budgets will place a spotlight on your values and priorities. They will give you a reigns to your finances which should pay off handsomely in the end.

3. Pay yourself First:

Financial author and entrepreneur David L. Bach of FinishRich says that you need to “save a dime out of every dollar.” A Federal Reserve report shows that at least half of all U.S citizens are incapable of meeting a $400 emergency on a rainy day.

Many of them though will pass by Starbucks every other day and will queue for newest iPhone for hours on end on Black Friday. These misplaced priorities are what leads to empty savings accounts. A 20% of all income should be the minimum amount set for your “pay-yourself-first plan.” “When that money is moved before you can touch it, that’s how real wealth is built,” Bach adds.

4. Clear the Debt Slate:

Credit cards have pushed more people to the brink of financial suicide more than any other form of credit facility ever invented. The average American adult has an accumulated credit card debt of $6,354. Of the massive $1 trillion U.S citizens owe as revolving debt, a staggering $830 billion of it is high-interest credit card debt. Paying off a credit card debt over long periods will cost you more than necessary. It can also lead to a degradation of your credit card scores. To hit your long term financial goals, you have to pay off all your bad debt first.

Begin with high-interest debts or bad credit loan borrowed from some reputable services first. You can direct a chunk of the 30% part of your 50, 30, 20 budget towards this end. Once you have paid off all your bad debt, ensure that you do not get caught up in it again. Makes all purchases as per your budget and leave those credit cards at home if you have to.

5. Protect your Family’s Future:

Death is not an easy issue to contemplate, especially your own. Getting life insurance though can help take care of your dependents if you are not around to do so. It is never too early. Go online, compare policies and apply.

6. Create Multiple Streams of Income:

A part-time hustle can help you to create a form of income insurance. This will ensure that you are less dependent on your income and are safer from the uncertainties of employment.

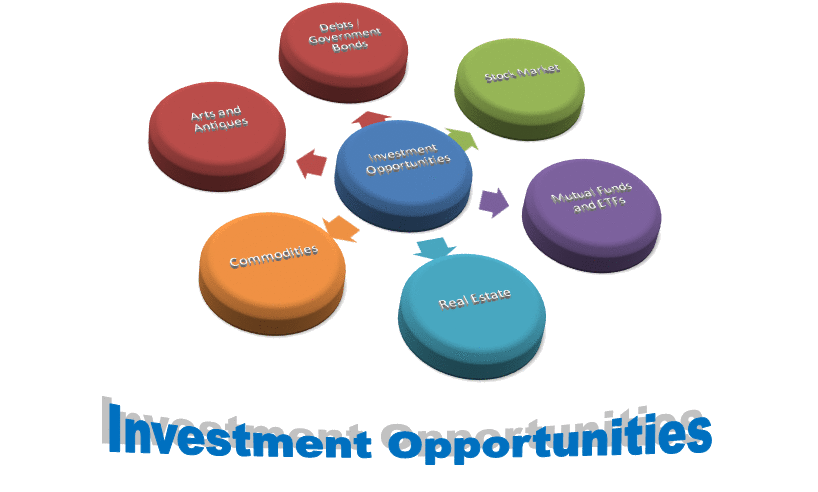

7. Do Not Sit on your Savings:

While saving 20% of your income is a virtue, sitting on all that cash could hurt your long term financial plans. If you are not investing your money, you are losing on opportunities to make more.

You could, for example, invest in the stock market. The guru of stock market investing, Berkshire Hathaway’s Warren Buffet advised that you should ‘play the long game; as an investor. “Our favorite holding period is forever,” once said Buffet. Being in the market in the long term pays off better than staying out of it. If you are risk averse you can save your money in a high-interest account for interest’s sake.

8. Build your Emergency Fund:

“No matter how well you plan or how positively you think, there are always things out of your control that can go wrong,” says David L. Bach in the “The Automatic Millionaire.” Life will surprise you at one point, or the other so have at least three to nine months of your living expenses squirreled away for a rainy day.

9. Invest in Real Estate:

Contrary to popular opinion you do need to be wealthy to join real estate investing. A minimum of $500 at Fundrise Starter Portfolio, for example, can get you into the market. Their quarterly dividends and shares are juicy. Grow your portfolio with time and move on to more significant real estate investments.

10. Pay More for your Mortgage:

A mortgage paid off earlier will save you thousands of dollars in interest. You will also have your home early. This should give you more peace of mind to pursue your other more risky investments goals with passion.

11. Save Aggressively towards your Retirement:

If your idea of aging gracefully is sipping a margarita in a deserted white sandy beach, you need to get busy with your retirement plan now. Establish your target and save at least 10 to 15 percent of your income to your retirement kitty. If your employer has a workplace-sponsored 401(k), march it.

12. Live Below your Means:

In your 20’s and 30’s, the pressure to conform to society is very high. The culture is very materialistic. Keep your fixed expenses stable and reasonable. Your home or car should not be budget busters. Live by the Fire philosophy of frugality; live below your means.

Conclusion:

“The biggest thing about making money is time,” said famed investor Warren Buffet in an interview. “You don’t have to be particularly smart, you just have to be patient,” he added. Stick to your financial plan and your budget and implement the tips herein to get financial freedom for next 20 years. It is the easiest way to set your finances in the right direction in the next few years.