The insurance policy outlines the claims that the insurer is require by law to cover in a written agreement (often in the form of a standard form contract) between the insurer and the policyholder. The insurer guarantees to cover losses brought on by risks covered by the policy language in return for an upfront payment known as the premium.

Because insurance contracts are designed to serve specific purposes, they contain a number of elements that are absent from many other types of contracts. Because insurance policies are standard forms, they contain boilerplate text that is common to many different types of insurance policies.

Insurance Definition

Protecting or safeguarding significant loss is refer as Insurance. It is a type of risk protection and wealth management strategy as a part of financial planning for an individual or an organisation. “Insurance companies offering insurance products are termed as Insurance Policy”.

In insurance policy insurer can cover cost of potential loss in exchange by paying insuring company nominal amount every year as a premium. Individuals, corporate or any other groups can safeguard their risk against any critical misfortunes at the reasonable rate know as premium.

Mostly risk covers are require where huge amount or high risk is involve in it. If potential loss is small, you would not pay monthly or yearly premiums. Assume that risk of loss against Rs.6,500/- (or around $100) misfortune and such losses would not stop your business operations or impact your financial planning.

Example of Insurance Policy

Protection is necessary when you need to ensure against a high risk losses. Let us take an insurance policy example to understand better. Consider you are the only source of income person for your family. Loss of income which family would encounter as a consequence of an unexpected premature death.

It would be extremely troublesome for your family to manage day to day needs since you are the only source of income for the family. Such kind high risk can be cover by insurance policy. Insuring by paying nominal monthly or yearly premiums. This will guarantee you that family will still get regular monthly pay check even after your death to your family for their day to day necessity.

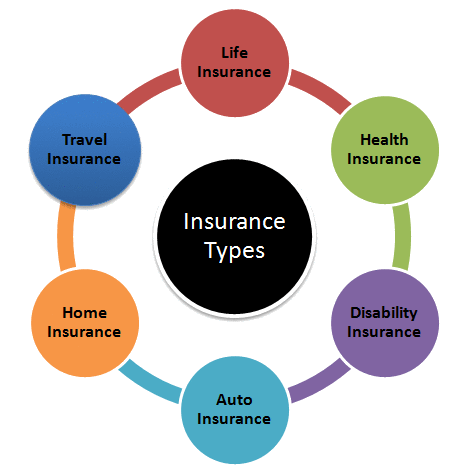

Types of Insurance Policies

- Life insurance protects your family in unforeseen situations like death or accidental death.

- Term life insurance is one of the types of life insurance for financial safety after your death will additional benefits.

- Health insurance facilitates you to insure coverage against surgical and medical expense.

- Disability insurance will insure you cover against physical disability for longer period with no productive work.

- Auto insurance facilities you to cover car or any vehicle against damages or accidents.

- Home insurance will protect your house against any damages like structural damage, fire, earthquake, etc.

- Travel insurance facilities you to insure losses occurred due to uncircumstances events during international or domestic travels.

Insurance Policies Coverage

There are various “different types of insurance policies”. Apart from covers of life or medical you can also cover your assets, debts, travels, properties, and many more. Anybody that needs to insure themselves or another person against financial losses should consider this seriously and should plan accordingly. Insurance policy include:

- Protecting family from loss of income from premature death.

- Ensuring obligation repayment after death.

- Covering unforeseen liability losses.

- Protecting business against the loss or disability of a critical employee.

- Buying out a partner or co-shareholder after his or her demise.

- Income protection insure from your job, business against unforeseen business stoppage.

- Protecting you against unforeseeable medical, health or hospital expenses.

- Protect your property from fire, thief, or any other natural calamities like flood, etc.

- Protecting assets against employee lawsuits.

- Protecting yourself in the event of disability.

- Protecting your car against theft or losses incurred because of accidents.

- And many more insurance policy…

Everyone on this planet insure in some form maybe it’s liability, auto, disability, medical or life insurance. Insurance policy is one of the best risk protection and prevention tool. Most of us take insurance for protection while large number of people do not understand what it is or how it functions. Selecting right sort of protection according to your needs is very crucial part of a great financial planning. Let us understand in next couple of tutorial sessions.

Insurance Policies Exclusions

The Insuring Agreement’s coverage is void due to exclusions. Three groups can be made up of exclusions:

- Risks that are under exclusions.

- Losses are not taken into account.

- There is no real estate inclusion.

Examples of risks that are not cover by a homeowners policy include flooding, earthquakes, and radioactive contamination. An example of an excluded loss under an auto insurance policy is wear and tear. Examples of personal property that is not cover by a homeowners policy include a car, a pet, or an aeroplane.

Conclusion

Insurance is important in the modern world. Even though many people purchase various types of insurance, not everyone is aware of the many advantages they offer. For instance, life insurance protects both your financial future and the future of your family. Additionally, buying life insurance promotes a regular saving schedule. As a result, you can amass a sizable corpus.

Read E-Learning Tutorial Courses - 100% Free for All