Three of the main goals of every business owner, whether the biz is a hole-in-the-wall eatery or a large corporation, are to increase profits, get new and bigger clients, and ultimately, grow and expand the business. As easy as they may sound, every company CEO knows that these goals are not a walk in the park.

Whenever businesses try to expand, they are always exposed to great financial risks. It’s either you go big or go home, especially for small businesses that are more susceptible to financial losses. But there’s a solution for every problem. If you’re worried about the great deal of risk that you’ll face if you try to expand, the best thing that you can do is to apply for credit insurance.

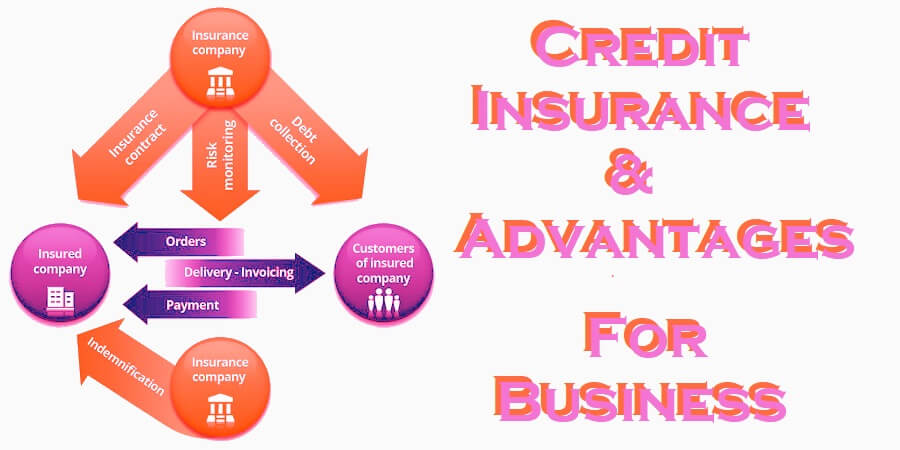

What is Credit Insurance?

Credit insurance means a safety net for businesses. If your customers or clients refuse to comply with their contractual obligations (which is one of the main reasons why companies suffer from financial losses), the insurance will pay for their outstanding debt.

The goal of credit insurance is pretty much the same as the objectives of any other types of insurance like car and health insurance. Credit insurance aims to protect the financial integrity of your company just in case problematic clients refuse to pay their dues.

Pros / Advantages of Credit Insurance

Getting credit insurance has its own advantages. Below are only some of them:

It allows you to be more flexible with your contracts:

One of the sure-fire ways to grow your company is to do business with the bigger ones. It may be a risky play, but it yields the best results.

To attract bigger clients, you must have the capacity to handle bigger contracts which is, again, a risky move for you. Especially if you’re just a small business, you can’t always afford to have bigger contracts. It could mean life and death to your business when your clients start to ghost you and refuse to pay for your service.

But if you have credit insurance, you can take more chances or bigger risks since you have a safety net that will catch you anytime. This kind of flexibility will also give you an advantage over your competitors and ultimately, help you to expand your business.

It gives you the confidence to tap into new markets:

Doing business with larger companies is scary. But going into unchartered territories is even more terrifying. It also poses great deals of risks because you are heading into business spaces that you are not familiar with.

But if you have credit insurance Melbourne, you have nothing else to worry about. Except for all the things that you have to do when expanding the business. With credit insurance, your cash flow is still protected even if you bring your business abroad.

Credit insurance companies can do credit checks for you:

Most companies that offer credit insurances can help you run a background check on your potential clients. They can give you real-time information about the credit history of your potential customers so you can decide whether it’s beneficial for the company to do business with them.

Benefits of Credit Insurance

Let us explore some of the benefits of credit insurance to understanding the concept in more detail.

- A superior relationship with your client

- Empowers organizations to expand credit terms

- Admittance to credit risk analysis and investigation

- Supports effective credit management measures

- Guides and supports deals to higher edge markets

- Moves risk to insurer’s accounting books

- Reduce bad debt obligations

- Safe and secured business to other countries

- Improved business payment cycle

Conclusion

These are only some of the reasons why having credit insurance is paramount to any kind of business, whether big or small. It can give you the financial security that you need if you’re planning to expand your business.

So whether you’re a small business owner or a CEO of a big company, you might want to consider getting credit insurance now!

With a safety net like credit insurance, you can make big decisions for the company without the worries of financial loss holding you back.