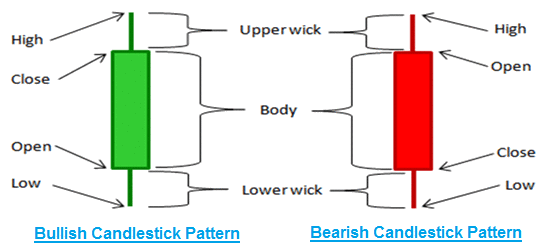

Margin Trading Definition:

Margin Trading is purchasing stocks without investing the full capital. The trades have a systematized strategy for purchasing stocks in future market without having the capital.

For example, Assume that you want to purchase 1000 shares of SBI, which exchanges at Rs.200, you will require around Rs.2,00,000. Whereas in margin trading, you purchase a future contract of SBI by paying 15% as margin. Which means that by investing Rs.30,000 you can get exposure to stock value of Rs.2,00,000

Margin Call:

Once the broker purchases a future or stocks in the margin account, the customer can see the daily profit and loss in his account. In case value of the stock price offered falls beneath the purchase price, the broker will request the customer to add extra margin to hold the position in margin trading. In a scenario when customer is unable to allocate extra margin, the broker square-off the stocks position to protect himself from risk due to fall in stock price.

This squaring-off position from broker’s end typically occurred when there is significant fall in stock price and customer does not have liquidity to meet the required margin. Or when customer takes benefit of over leverage and slight fall in price can impact hugely to the customer due to over risk. Under those circumstances broker has to mandatory sell the open position of the customer.

The Advantages of Margin Trading:

Leverage is of the greatest advantage in margin trading. Margin can increase your profits dramatically. For example: with 10% of margin you can buy 10 times of the cash stocks in future market.

Let us take an example to better understand the advantage of leverage. Assume that you want to buy 1000 shares of SBI, at Rs.200 in cash market, then you will require Rs.2,00,000 to purchase the SBI stocks. Whereas in 10% margin trading, with capital of Rs.2,00,000 you purchase 10,000 SBI shares in future market. Suppose in near term SBI stock price rise with Rs.10, then in cash market you will earn profit of Rs.10,000 (1000 Shares * Rs.10). Whereas in margin trading your profit will be Rs.1,00,000 (10,000 Shares * Rs.10). This margin gives you the clear picture that margin trading gives you the opportunity to maximize your profits.

Risks of Margin Trading:

Margin account at the same time are too risky and are not for all the customers. Those who enter into margin trading without proper knowledge will have to suffer a huge losses. This is because leverage increases the risk to your capital investment.

For example: Assume that you want to buy 1000 shares of SBI, which is trading at Rs.200 with the intension of getting out with 15% profit. Through 15% margin on future contract, you can buy 1000 shares of SBI at Rs.30,000. One fine day when stock price fall 15% then broker has to sell your open position due to shortfall of margin. In this scenario, your capital loss is 100% which is too much. Even a loss of 15% can turn your account into bankrupt. Whereas in the cash account, your loss is only 15% and you can still hold the position with the intension of recovery in the short term.

Read E-Learning Tutorial Courses - 100% Free for All

Basics of Futures Trading for Beginners

- Chapter 1: What is Futures Contract and Types of Future Contracts?

- Chapter 2: What is Futures Trade and How to Trade in Future Markets?

- Chapter 3: What is Leverage and Payoff? Definition with Example

- Chapter 4: What is Shorting or Short Sale? Definition and Rules

- Chapter 5: What is Nifty Futures and How to Trade in Nifty futures?

- Chapter 6: What are Futures Prices? Definition and Effects of Dividends

- Chapter 7: What is Hedging? Examples and Hedging Strategies

- Chapter 8: What is Open Interest? Examples and Analysis

- Chapter 9: What is Margin and M2M (Mark to Market)?

- » Currently Reading: What is Margin Trading? Advantages and Risk of Leverage.

- Chapter 11: What is Hedger, Speculator and Margin Calculation?

- Chapter 12: Futures Trading Quiz – Basics of Futures Trading for Beginners